Sipc Brochure

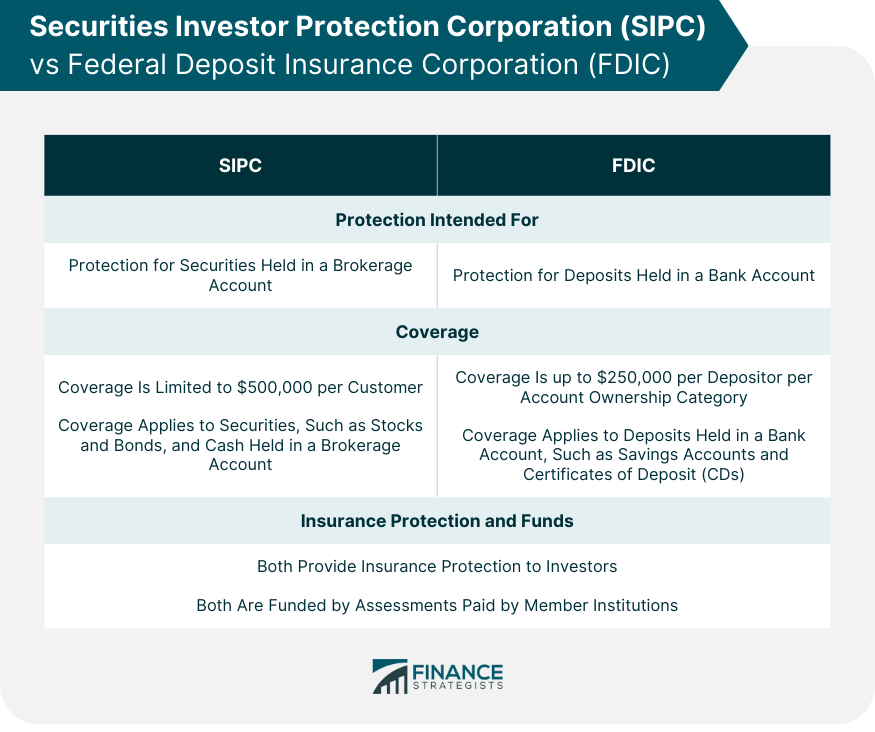

Sipc Brochure - You may obtain more information about sipc, including the sipc brochure regarding investor protection, by visiting sipc's website, www.sipc.org, or by calling sipc at 202.371.8300. Sipc funds protect clients of its members against insolvency or liquidation, similar to how the fdic protects bank deposits. The money required to protect clients is advanced by sipc from. Sipc, investors at financially troubled brokerage firms might lose their investments forever. Download or view sipc brochures here. For member firms sipc member brokerage firms can find information here about filing requirements, the sipc assessment, and the sipc logo. Read this brochure carefully to learn. Securities investor protection corporation (“sipc”), which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Sipc is a nonprofit corporation that’s has. The securities investor protection corporation does notoffer to investors the same blanket protection that the federal deposit insurance corporation provides to bank depositors. The securities investor protection corporation (sipc) protects customers if their brokerage firm fails. You may obtain more information about sipc, including the sipc brochure regarding investor protection, by visiting sipc's website, www.sipc.org, or by calling sipc at 202.371.8300. Sipc is a nonprofit corporation that’s has. For member firms sipc member brokerage firms can find information here about filing requirements, the sipc assessment, and the sipc logo. Download or view sipc brochures here. The money required to protect clients is advanced by sipc from. Securities investor protection corporation (“sipc”), which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Bny pershing is a member of sipc, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Sifma members receive discounted pricing. Securities investor protection corporation avoiding investment fraud learn about investment fraud…and where to turn for help. The securities investor protection corporation does notoffer to investors the same blanket protection that the federal deposit insurance corporation provides to bank depositors. Securities investor protection corporation (“sipc”), which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). The money required to protect clients is advanced by sipc from. You may obtain more information. Securities investor protection corporation (“sipc”), which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Not every investor, and not every loss, is protected by sipc. For member firms sipc member brokerage firms can find information here about filing requirements, the sipc assessment, and the sipc logo. Download or view sipc brochures here. Sipc. If it happens, sipc protects the securities and cash in. Brokerage firm failures are rare. Sipc, investors at financially troubled brokerage firms might lose their investments forever. Download or view sipc brochures here. Securities investor protection corporation (“sipc”), which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). For member firms sipc member brokerage firms can find information here about filing requirements, the sipc assessment, and the sipc logo. The securities investor protection corporation does notoffer to investors the same blanket protection that the federal deposit insurance corporation provides to bank depositors. For member firms sipc member brokerage firms can find information here about filing requirements, the sipc. Brokerage firm failures are rare. Securities investor protection corporation avoiding investment fraud learn about investment fraud…and where to turn for help. Download or view sipc brochures here. Read this brochure carefully to learn. The first investor bulletin (“sipc basics”) will provide investors with an overview of how sipc protection works and what it protects, and the second investor bulletin (“filing. Download or view sipc brochures here. Sifma members receive discounted pricing. Sipc funds protect clients of its members against insolvency or liquidation, similar to how the fdic protects bank deposits. The money required to protect clients is advanced by sipc from. Securities investor protection corporation (“sipc”), which protects securities customers of its members up to $500,000 (including $250,000 for claims. The money required to protect clients is advanced by sipc from. Sipc urges all investors to understand the. If it happens, sipc protects the securities and cash in. Download or view sipc brochures here. Brokerage firm failures are rare. Sipc, investors at financially troubled brokerage firms might lose their investments forever. Not every investor, and not every loss, is protected by sipc. Download or view sipc brochures here. Brokerage firm failures are rare. Sipc funds protect clients of its members against insolvency or liquidation, similar to how the fdic protects bank deposits. For member firms sipc member brokerage firms can find information here about filing requirements, the sipc assessment, and the sipc logo. For member firms sipc member brokerage firms can find information here about filing requirements, the sipc assessment, and the sipc logo. The securities investor protection corporation (sipc) protects customers if their brokerage firm fails. Download or view sipc brochures. You may obtain more information about sipc, including the sipc brochure regarding investor protection, by visiting sipc's website, www.sipc.org, or by calling sipc at 202.371.8300. Not every investor, and not every loss, is protected by sipc. Sifma members receive discounted pricing. If it happens, sipc protects the securities and cash in. Download or view sipc brochures here. If it happens, sipc protects the securities and cash in. Securities investor protection corporation avoiding investment fraud learn about investment fraud…and where to turn for help. You may obtain more information about sipc, including the sipc brochure regarding investor protection, by visiting sipc's website, www.sipc.org, or by calling sipc at 202.371.8300. For member firms sipc member brokerage firms can find information here about filing requirements, the sipc assessment, and the sipc logo. Sipc urges all investors to understand the. The securities investor protection corporation (sipc) protects customers if their brokerage firm fails. Download or view sipc brochures here. Sipc, investors at financially troubled brokerage firms might lose their investments forever. Sifma members receive discounted pricing. Download or view sipc brochures here. Official publication and member identification materials of the securities investor protection corporation (sipc). Brokerage firm failures are rare. The first investor bulletin (“sipc basics”) will provide investors with an overview of how sipc protection works and what it protects, and the second investor bulletin (“filing a. For member firms sipc member brokerage firms can find information here about filing requirements, the sipc assessment, and the sipc logo. Bny pershing is a member of sipc, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). For member firms sipc member brokerage firms can find information here about filing requirements, the sipc assessment, and the sipc logo.SIPC Brochure English 2020 25/pack

How FDIC and SIPC Insurance works Mustang Private Wealth

SIPC Securities Investor Protection Corporation

SIPC Protection Everything You Need to Know to Protect Your

Securities Investor Protection Corporation (SIPC)

Brochure SAS SIPC Eng Arteche PDF Command Line Interface

SIPC Eng PDF Electrical Substation Command Line Interface

Understanding SIPC and FDIC coverage Ameriprise Financial (2025)

SIPC Brochure Spanish 2020 25/pack

The Context Dr Brian Robson Medical Director NHS QIS ppt download

The Securities Investor Protection Corporation Does Notoffer To Investors The Same Blanket Protection That The Federal Deposit Insurance Corporation Provides To Bank Depositors.

Sipc Funds Protect Clients Of Its Members Against Insolvency Or Liquidation, Similar To How The Fdic Protects Bank Deposits.

The Money Required To Protect Clients Is Advanced By Sipc From.

Read This Brochure Carefully To Learn.

Related Post: