Options Brochure

Options Brochure - A pdf file of the complete brochure is also available. • expiration date (usually the third friday of the month) • strike price •. A breakdown of key options strategies to help you better understand the characteristics and implications of each. An option is a contract between two parties giving the. Explore the odd, expiration calendars, options strategies, and guide to investing with options to understand options characteristics and strategies. In this brochure we explain the basics of an option: As firstrade’s guide to buying options, we bring you these three beginner videos on options, covered calls, and equity collars, presented by the options industry council (oic). Electronic delivery of the odd is permissible if the requirements for electronic delivery as. Get to know the basics of options investing; You can use options to protect gains, control large chunks of stock or. The strike price, the underlying asset (also called the underlying value), the contract size, and the point in time at which you can make. In this brochure we explain the basics of an option: As firstrade’s guide to buying options, we bring you these three beginner videos on options, covered calls, and equity collars, presented by the options industry council (oic). The strategy is to buy call options with the expectation that the stock. An option is simply a contractual agreement between two parties, the buyer and the seller. In this chapter, we will explain the basics of how options work and how they are usually employed in today’s modern financial markets. The document provides an introduction to options, covering key concepts such as: Understand what to expect when buying options; You can protect stock holdings from a decline in market price. In our ongoing effort to meet the growing demand for equity options education, the options industry council (oic) is offering several new publications. Electronic delivery of the odd is permissible if the requirements for electronic delivery as. An option is simply a contractual agreement between two parties, the buyer and the seller. You can protect stock holdings from a decline in market price. Learn key terms and concepts essential for any new options trader. • expiration date (usually the third friday of the. Get to know the basics of options investing; • expiration date (usually the third friday of the month) • strike price •. The strike price, the underlying asset (also called the underlying value), the contract size, and the point in time at which you can make. A pdf file of the complete brochure is also available. The strategy is to. Through the programs and services of the options industry council (oic), occ has created an odd quick guide to support your understanding of the disclosure document, characteristics. Explore the world of options investing with our comprehensive guide. In this brochure we explain the basics of an option: In this chapter, we will explain the basics of how options work and. Cme group’s vast and liquid family of option contracts on futures can help you diversify your portfolio while helping to mitigate your downside risk. For more information about our clearing firm, please visit velox clearing, llc. The strategy is to buy call options with the expectation that the stock. Explore the world of options investing with our comprehensive guide. •. Explore the world of options investing with our comprehensive guide. A pdf file of the complete brochure is also available. You can use options to protect gains, control large chunks of stock or. Learn key terms and concepts essential for any new options trader. • expiration date (usually the third friday of the month) • strike price •. Please review the characteristics and risks of standardized options brochure before you begin trading options. Learn strategies, risks, and maximize your financial potential. An option is simply a contractual agreement between two parties, the buyer and the seller. Electronic delivery of the odd is permissible if the requirements for electronic delivery as. You can use options to protect gains, control. Understand what to expect when buying options; For more information about our clearing firm, please visit velox clearing, llc. Explore the world of options investing with our comprehensive guide. An option is simply a contractual agreement between two parties, the buyer and the seller. Get to know the basics of options investing; Options give you options by providing the ability to tailor your position to your situation. You can use options to protect gains, control large chunks of stock or. In our ongoing effort to meet the growing demand for equity options education, the options industry council (oic) is offering several new publications. Click on a link below to view the corresponding. The strike price, the underlying asset (also called the underlying value), the contract size, and the point in time at which you can make. An option is simply a contractual agreement between two parties, the buyer and the seller. Learn strategies, risks, and maximize your financial potential. Get to know the basics of options investing; The document provides an introduction. Electronic delivery of the odd is permissible if the requirements for electronic delivery as. Option trading is a way for investors to leverage assets and control some of the risks associated with playing the market. The strike price, the underlying asset (also called the underlying value), the contract size, and the point in time at which you can make. You. The strike price, the underlying asset (also called the underlying value), the contract size, and the point in time at which you can make. In our ongoing effort to meet the growing demand for equity options education, the options industry council (oic) is offering several new publications. Options give you options by providing the ability to tailor your position to your situation. Electronic delivery of the odd is permissible if the requirements for electronic delivery as. Option trading is a way for investors to leverage assets and control some of the risks associated with playing the market. You can protect stock holdings from a decline in market price. Learn strategies, risks, and maximize your financial potential. Cme group’s vast and liquid family of option contracts on futures can help you diversify your portfolio while helping to mitigate your downside risk. • expiration date (usually the third friday of the month) • strike price •. An option is a contract between two parties giving the. Click on a link below to view the corresponding brochure content. A breakdown of key options strategies to help you better understand the characteristics and implications of each. As firstrade’s guide to buying options, we bring you these three beginner videos on options, covered calls, and equity collars, presented by the options industry council (oic). In this chapter, we will explain the basics of how options work and how they are usually employed in today’s modern financial markets. You can use options to protect gains, control large chunks of stock or. Explore the odd, expiration calendars, options strategies, and guide to investing with options to understand options characteristics and strategies.Presentation Infographic Template With 5 Options Brochure Template Download on Pngtree

35+ Marketing Brochure Examples, Tips and Templates Venngage

Infographic Design Elements For Your Business With 9 Options Brochure Template Download on Pngtree

Infographic Design Template With 9 Options Brochure Template Download on Pngtree

Circle Infographic Template Five Option Brochure Template Download on Pngtree

Vector Illustration Infographics 6 Options Brochure Template Download on Pngtree

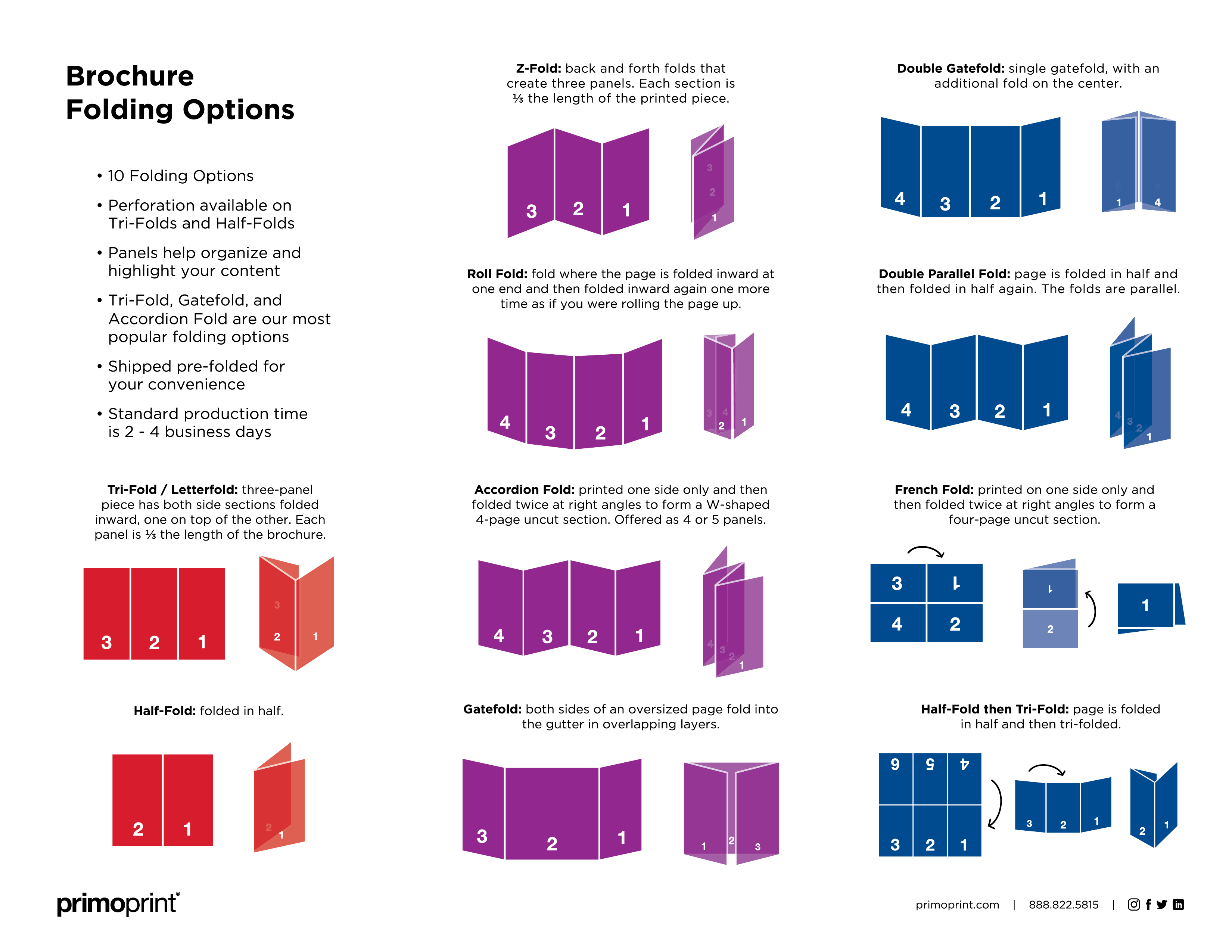

The Complete List of Brochure Folds Primoprint Blog

Business Presentation 9 Options Brochure Design Stock Vector (Royalty Free) 1640838106

Investment Portfolio Options Brochure Template Edit Online & Download Example

Business Infographic Labels Template With 5 Options Brochure Template Download on Pngtree

Learn Key Terms And Concepts Essential For Any New Options Trader.

The Strategy Is To Buy Call Options With The Expectation That The Stock.

Through The Programs And Services Of The Options Industry Council (Oic), Occ Has Created An Odd Quick Guide To Support Your Understanding Of The Disclosure Document, Characteristics.

An Option Is Simply A Contractual Agreement Between Two Parties, The Buyer And The Seller.

Related Post: