Invesco Solo 401K Brochure

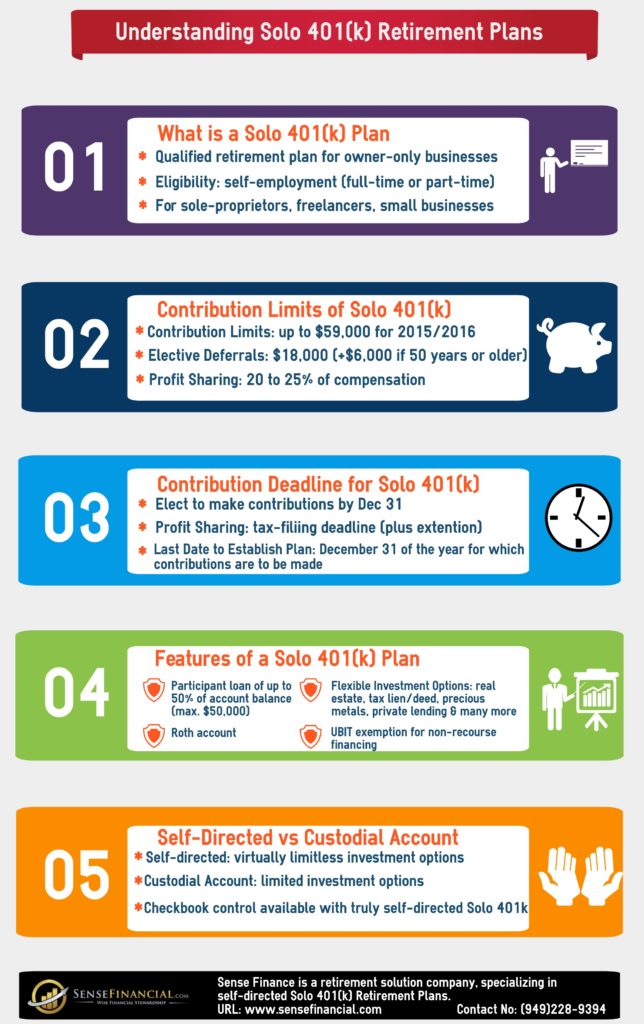

Invesco Solo 401K Brochure - Use this form to designate or modify the beneficiary(ies) on your invesco ira (including traditional, roth, sep, sarsep and simple), 403(b) or optional retirement program (orp). Invesco solo 401(k) ® participant enrollment form. Invesco solo 401(k) secure 2.0 plan features and requirements document invesco solo 401(k) administrative. The invesco solo 401(k) offers the same savings potential of a 401(k) plan for a large company, but without the compliance requirements or administrative costs. Consistent income.downside risk mitigation.potential benefits:less volatility. Use this form to establish a participant account for the business owner (and spouse, if applicable) in. We recommend that you speak with a tax advisor or financial professional regarding the consequences of this. Solo 401(k)® beneficiary transfer/distribution form use this form to request a transfer or distribution from a deceased participant’s solo 401(k) account or existing beneficiary status. Request a loan from an invesco solo 401(k) or 403(b)(7). Invesco solo 401(k) and 403(b)(7) loan application and agreement: Avoid one size fits allfree webinarsflexible investments28 years of experience Use this form to establish a participant account for the business owner (and spouse, if applicable) in. Rpm provides plan sponsors the tools they need to more effectively manage their. The invesco solo 401(k) offers the same savings potential of a 401(k) plan for a large company, but without the compliance requirements or administrative costs. For information on loans, see the invesco solo 401(k) and 403(b)(7) loan application and agreement, available online at invesco.com/us or by calling invesco client. Use this form to designate or modify the beneficiary(ies) on your invesco ira (including traditional, roth, sep, sarsep and simple), 403(b) or optional retirement program (orp). Safe harbor, age weighted, and new comparability. Invesco solo 401(k)® participant enrollment form use this form to establish a participant account for the business owner (and spouse, if applicable) in an invesco solo 401(k) plan. Invesco solo 401(k) ® participant enrollment form. Consistent income.downside risk mitigation.potential benefits:less volatility. Request a loan from an invesco solo 401(k) or 403(b)(7). Discover the benefits, contribution types, investment options, and eligibility requirements for this powerful. We recommend that you speak with a tax advisor or financial professional regarding the consequences of this. Use this form to establish a participant account for the business owner (and spouse, if applicable) in. Use this form. Compared to regular iras, solo 401(k) plans offer a whole lot more for solopreneurs: Discover the benefits, contribution types, investment options, and eligibility requirements for this powerful. Request a loan from an invesco solo 401(k) or 403(b)(7). Use this form to designate or modify the beneficiary(ies) on your invesco ira (including traditional, roth, sep, sarsep and simple), 403(b) or optional. • larger contribution limits and flexibility • roth component with no income limits • checkbook control •. Discover the benefits, contribution types, investment options, and eligibility requirements for this powerful. The invesco solo 401(k) product is still appropriate for your situation: Required age 62+instant online quotepersonal 1 on 1 supportgreat heloc alternative Use this form to request a distribution from. Use this form to establish a participant account for the business owner (and spouse, if applicable) in. To get started, enter the provided user name and password. Consistent income.downside risk mitigation.potential benefits:less volatility. Required age 62+instant online quotepersonal 1 on 1 supportgreat heloc alternative Rpm provides plan sponsors the tools they need to more effectively manage their. Use this form to request a distribution from a participant’s solo 401(k) account. Required age 62+instant online quotepersonal 1 on 1 supportgreat heloc alternative Request a loan from an invesco solo 401(k) or 403(b)(7). Use this form to establish a participant account for the business owner (and spouse, if applicable) in. Invesco solo 401(k) ® participant enrollment form. Request a loan from an invesco solo 401(k) or 403(b)(7). Invesco solo 401(k) and 403(b)(7) loan application and agreement: For information on loans, see the invesco solo 401(k) and 403(b)(7) loan application and agreement, available online at invesco.com/us or by calling invesco client. Then click the 'continue' button below. Consistent income.downside risk mitigation.potential benefits:less volatility. Consistent income.downside risk mitigation.potential benefits:less volatility. Solo 401(k)® beneficiary transfer/distribution form use this form to request a transfer or distribution from a deceased participant’s solo 401(k) account or existing beneficiary status. Discover the benefits, contribution types, investment options, and eligibility requirements for this powerful. To get started, enter the provided user name and password. For information on loans, see the. Invesco solo 401(k) secure 2.0 plan features and requirements document invesco solo 401(k) administrative. Invesco solo 401(k)® participant enrollment form use this form to establish a participant account for the business owner (and spouse, if applicable) in an invesco solo 401(k) plan. Invesco solo 401(k) and 403(b)(7) loan application and agreement: Use this form to establish a participant account for. Discover the benefits, contribution types, investment options, and eligibility requirements for this powerful. Safe harbor, age weighted, and new comparability. Invesco solo 401(k) ® participant enrollment form. Invesco solo 401(k)® participant enrollment form use this form to establish a participant account for the business owner (and spouse, if applicable) in an invesco solo 401(k) plan. Use this form to establish. Invesco solo 401(k) ® participant enrollment form. Use this form to request a distribution from a participant’s solo 401(k) account. Invesco solo 401(k)® participant enrollment form use this form to establish a participant account for the business owner (and spouse, if applicable) in an invesco solo 401(k) plan. Rpm provides plan sponsors the tools they need to more effectively manage. We recommend that you speak with a tax advisor or financial professional regarding the consequences of this. Safe harbor, age weighted, and new comparability. Invesco solo 401(k)® participant enrollment form use this form to establish a participant account for the business owner (and spouse, if applicable) in an invesco solo 401(k) plan. Use this form to designate or modify the beneficiary(ies) on your invesco ira (including traditional, roth, sep, sarsep and simple), 403(b) or optional retirement program (orp). Compared to regular iras, solo 401(k) plans offer a whole lot more for solopreneurs: For information on loans, see the invesco solo 401(k) and 403(b)(7) loan application and agreement, available online at invesco.com/us or by calling invesco client. Use this form to establish a participant account for the business owner (and spouse, if applicable) in. Invesco solo 401(k) and 403(b)(7) loan application and agreement: The invesco solo 401(k) product is still appropriate for your situation: To get started, enter the provided user name and password. • larger contribution limits and flexibility • roth component with no income limits • checkbook control •. Required age 62+instant online quotepersonal 1 on 1 supportgreat heloc alternative The invesco solo 401(k) offers the same savings potential of a 401(k) plan for a large company, but without the compliance requirements or administrative costs. Use this form to request a distribution from a participant’s solo 401(k) account. Then click the 'continue' button below. Solo 401(k)® beneficiary transfer/distribution form use this form to request a transfer or distribution from a deceased participant’s solo 401(k) account or existing beneficiary status.Fillable Online invesco solo 401k form Fax Email Print pdfFiller

Solo 401(k) Thanks Modern Financial Advisors

Online access to Invesco Solo 401(k) plans

How To Set Up Solo 401(k) Plans For SelfEmployed Workers

Solo 401(k) How it Works IRA Financial Group

Solo 401(k) Invesco US

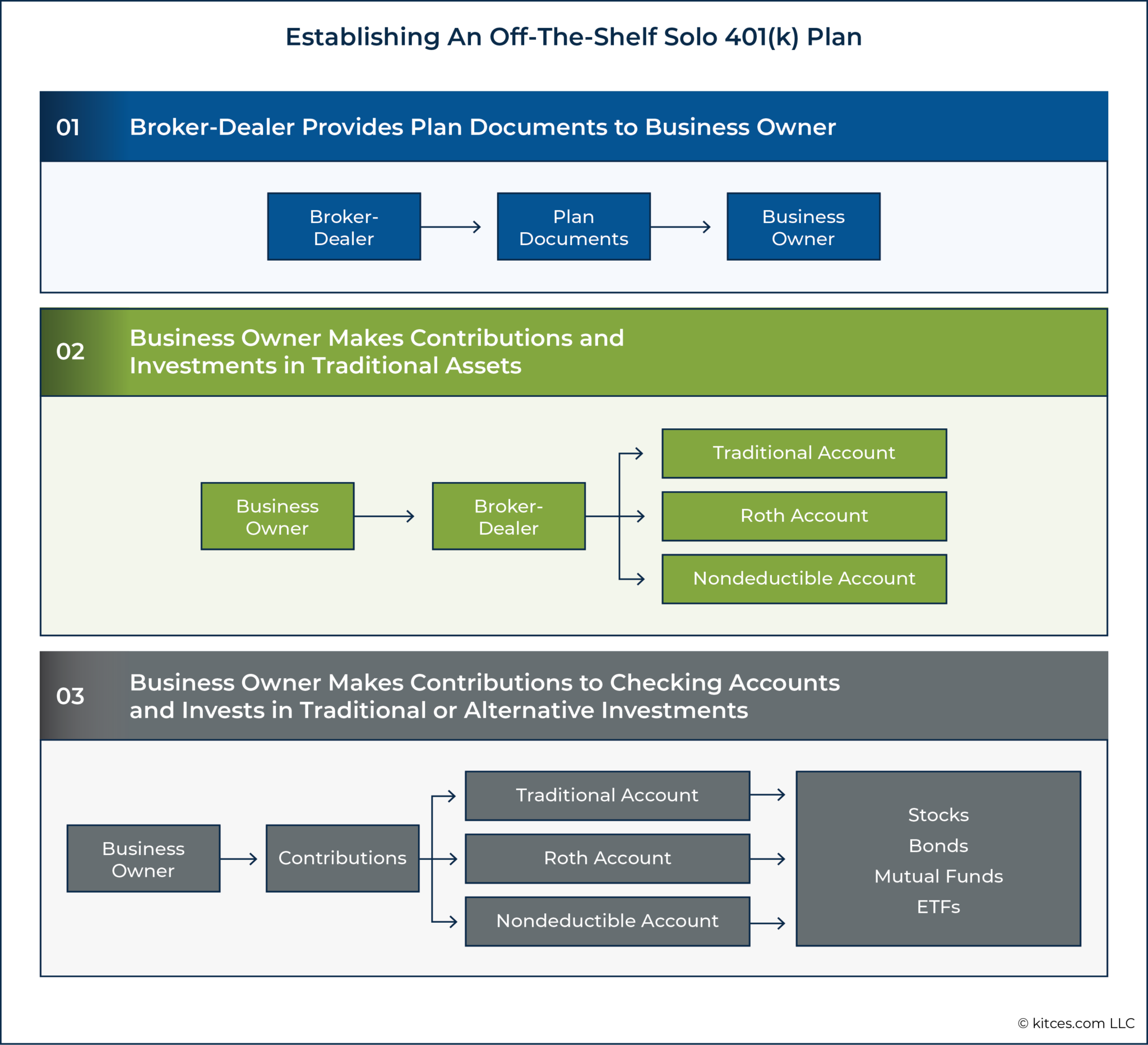

Solo 401k Process (Flowchart)

Solo 401(k) Infographic A RealtorFriendly Retirement Plan

How To Set Up Solo 401(k) Plans For SelfEmployed Workers

con ed 401k

There’s A Perfectly Legal Method To Get To Your Retirement Plan Money At Age 55 Without Paying A Penalty, And It’s Called The Solo 401K.

Discover The Benefits, Contribution Types, Investment Options, And Eligibility Requirements For This Powerful.

Avoid One Size Fits Allfree Webinarsflexible Investments28 Years Of Experience

It Offers Business Owners Greater Savings Potential Than Other Small Business Retirement Plans.

Related Post: