Boi Brochure

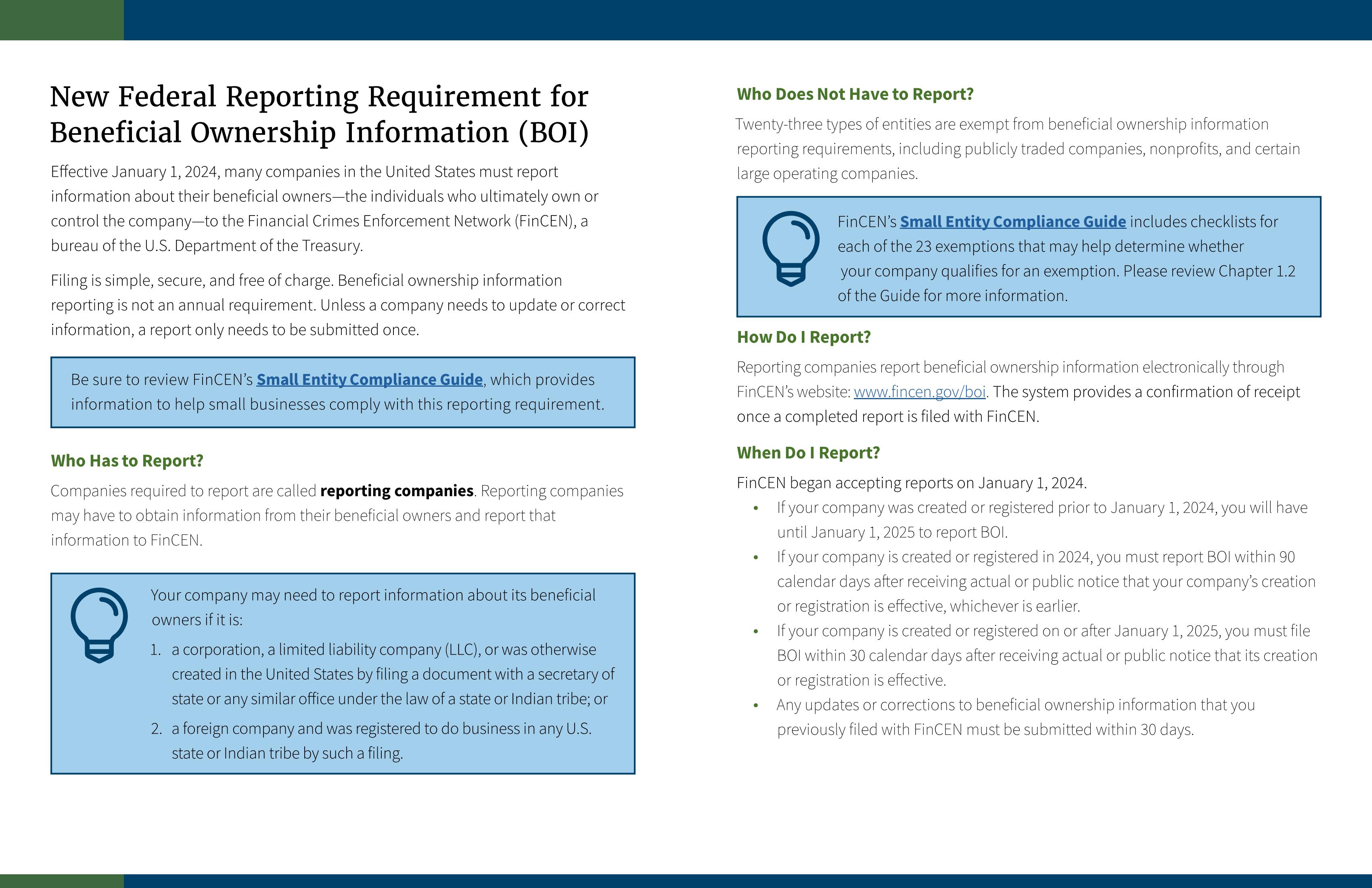

Boi Brochure - Beneficial ownership information (boi) effective january 1, 2024, many companies in the united states must report information about their beneficial owners—the individuals who ultimately. In 2021, congress enacted the corporate transparency act. The financial crimes enforcement network (fincen) of the u.s. The financial crimes enforcement network (fincen) of the u.s. Government’s eforts to make it. This law creates a beneficial ownership information reporting requirement as part of the u.s. Beneficial ownership information (boi) effective january 1, 2024, many companies in the united states must report information about their beneficial owners—the individuals who ultimately. With an estimated 30 million businesses subject to the new beneficial ownership information (boi) requirements, there's a unique opportunity to expand your services and offer your clients. Treasury department today issued additional guidance materials for the beneficial ownership. Fincen has published a new informational brochure, an introduction to beneficial ownership information reporting, and updated its beneficial ownership information. Reporting companies report beneficial ownership information electronically through fincen’s website: Beneficial ownership information (boi) effective january 1, 2024, many companies in the united states must report information about their beneficial owners—the individuals who ultimately. This law creates a beneficial ownership information reporting requirement as part of the u.s. Treasury department today issued additional guidance materials for the beneficial ownership information (boi) reporting. Fincen has announced that beneficial ownership information (boi) reporting is now a requirement (no longer just voluntary) with a filing deadline of march, 21 2025. Beneficial ownership information (boi) beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals. The system provides a confirmation of receipt once a completed. Fincen has published a new informational brochure, an introduction to beneficial ownership information reporting, and updated its beneficial ownership information. Beneficial ownership information (boi) beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals. Your company may need to comply with a new federal filing requirement. Government’s eforts to make it. Beneficial ownership information (boi) effective january 1, 2024, many companies in the united states must report information about their beneficial owners—the individuals who ultimately. Your company may need to comply with a new federal filing requirement. Beneficial ownership information (boi) beginning on january 1, 2024, many companies in the united states will have to report. Beneficial ownership information (boi) beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals. Fincen has announced that beneficial ownership information (boi) reporting is now a requirement (no longer just voluntary) with a filing deadline of march, 21 2025. With an estimated 30 million businesses subject to. Beneficial ownership information (boi) effective january 1, 2024, many companies in the united states must report information about their beneficial owners—the individuals who ultimately. Beneficial ownership information (boi) beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals. Treasury department today issued additional guidance materials for the. Fincen has published a new informational brochure, an introduction to beneficial ownership information reporting, and updated its beneficial ownership information. Beneficial ownership information (boi) effective january 1, 2024, many companies in the united states must report information about their beneficial owners—the individuals who ultimately. Beneficial owners are now exempt from the requirement to report beneficial ownership information (boi) to the. Beneficial ownership information (boi) effective january 1, 2024, many companies in the united states must report information about their beneficial owners—the individuals who ultimately Fincen has announced that beneficial ownership information (boi) reporting is now a requirement (no longer just voluntary) with a filing deadline of march, 21 2025. The financial crimes enforcement network (fincen) of the u.s. Beneficial ownership. Beneficial ownership information (boi) effective january 1, 2024, many companies in the united states must report information about their beneficial owners—the individuals who ultimately. Treasury department today issued additional guidance materials for the beneficial ownership information (boi) reporting. Beneficial ownership information (boi) beginning on january 1, 2024, many companies in the united states will have to report information about their. With an estimated 30 million businesses subject to the new beneficial ownership information (boi) requirements, there's a unique opportunity to expand your services and offer your clients. Government’s eforts to make it. Learn more about beneficial ownership reporting: Fincen has announced that beneficial ownership information (boi) reporting is now a requirement (no longer just voluntary) with a filing deadline of. Reporting companies report beneficial ownership information electronically through fincen’s website: The financial crimes enforcement network (fincen) of the u.s. Treasury department today issued additional guidance materials for the beneficial ownership. The financial crimes enforcement network (fincen) of the u.s. Beneficial ownership information (boi) effective january 1, 2024, many companies in the united states must report information about their beneficial owners—the. Beneficial owners are now exempt from the requirement to report beneficial ownership information (boi) to the financial crimes enforcement network (fincen) under the corporate. Fincen has announced that beneficial ownership information (boi) reporting is now a requirement (no longer just voluntary) with a filing deadline of march, 21 2025. The financial crimes enforcement network (fincen) of the u.s. Beneficial ownership. Beneficial ownership information (boi) effective january 1, 2024, many companies in the united states must report information about their beneficial owners—the individuals who ultimately Treasury department today issued additional guidance materials for the beneficial ownership. The financial crimes enforcement network (fincen) of the u.s. Government’s eforts to make it. Fincen has published a new informational brochure, an introduction to beneficial. Beneficial ownership information (boi) beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals. Beneficial ownership information (boi) effective january 1, 2024, many companies in the united states must report information about their beneficial owners—the individuals who ultimately. Beneficial ownership information (boi) beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals. Beneficial ownership information (boi) beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals. Treasury department today issued additional guidance materials for the beneficial ownership. This law creates a beneficial ownership information reporting requirement as part of the u.s. The system provides a confirmation of receipt once a completed. Government’s eforts to make it. Fincen has announced that beneficial ownership information (boi) reporting is now a requirement (no longer just voluntary) with a filing deadline of march, 21 2025. With an estimated 30 million businesses subject to the new beneficial ownership information (boi) requirements, there's a unique opportunity to expand your services and offer your clients. Beneficial ownership information (boi) effective january 1, 2024, many companies in the united states must report information about their beneficial owners—the individuals who ultimately In 2021, congress enacted the corporate transparency act. Beneficial ownership information (boi) beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals. Your company may need to comply with a new federal filing requirement. Beneficial ownership information (boi) effective january 1, 2024, many companies in the united states must report information about their beneficial owners—the individuals who ultimately. Learn more about beneficial ownership reporting:BOI The Board of Investment of Thailand

Beneficial Ownership Information Grandview Bank

BOI The Board of Investment of Thailand

BOI 2023 Information Handout Released Practicemock

(PDF) BOIBrochureWhyAW [Converted] · Title BOIBrochureWhyAW

BOI The Board of Investment of Thailand

BOIbrochure 2015Automotive20150325 70298 PDF Plug In Hybrid Car

corporate boifold brochure cover or annual report cover design EPS

BOI Informational Brochure 508C PDF Private Law Justice

BOI The Board of Investment of Thailand

The Financial Crimes Enforcement Network (Fincen) Of The U.s.

Beneficial Owners Are Now Exempt From The Requirement To Report Beneficial Ownership Information (Boi) To The Financial Crimes Enforcement Network (Fincen) Under The Corporate.

Beneficial Ownership Information (Boi) Effective January 1, 2024, Many Companies In The United States Must Report Information About Their Beneficial Owners—The Individuals Who Ultimately.

Fincen Has Published A New Informational Brochure, An Introduction To Beneficial Ownership Information Reporting, And Updated Its Beneficial Ownership Information.

Related Post:

![(PDF) BOIBrochureWhyAW [Converted] · Title BOIBrochureWhyAW](https://img.dokumen.tips/doc/image/5f5889c69cf9ed11d37ff8b8/boi-brochure-why-aw-converted-title-boi-brochure-why-aw-converted-author-admin.jpg)