American Funds Target Date Brochure

American Funds Target Date Brochure - American funds target date series is a “through” offering thus the underlying investment allocations continue adjusting along the glide path for thirty years beyond the named target See why target date funds are a smart choice for investing for retirement, and learn about the american funds target date retirement series. This brochure provides insight into analysis and selection of a target date series for a retirement plan based on five key considerations: You must log in to order literature. This brochure provides an overview of the american funds and capital group. The advisor attempts to achieve. 4&5 star fundsdetailed statisticsetf performancedaily nav Although the target date funds are actively managed for investors on a projected retirement date timeframe, the fund's allocation strategy does not guarantee that investors' retirement goals. The 11 funds in the american funds target date retirement series® are designed around retirement dates that are spaced five years apart, ranging from 2010 to 2060. The advisor attempts to achieve. You must log in to order literature. This brochure provides an overview of the american funds and capital group. Participant needs, glide path construction, cost versus. This brochure provides insight into analysis and selection of a target date series for a retirement plan based on five key considerations: Although the target date funds are actively managed for investors on a projected retirement date timeframe, the fund's allocation strategy does not guarantee that investors' retirement goals. The advisor attempts to achieve. 4&5 star fundsdetailed statisticsetf performancedaily nav Search by title, subject, literature number, fund or cover description. The target date fund’s adviser shifts the target date fund’s assets among the various underlying funds over time, consistent with the fund’s own investment strategy. The 11 funds in the american funds target date retirement series® are designed around retirement dates that are spaced five years apart, ranging from 2010 to 2060. The advisor attempts to achieve. This brochure provides an overview of the american funds and capital group. Participant needs, glide path construction, cost versus. The 11 funds in the american funds target date retirement series® are designed around retirement dates that are spaced five years apart, ranging from 2010 to 2060. Describes all of american funds' managed portfolios offerings, including. The target date fund’s adviser shifts the target date fund’s assets among the various underlying funds over time, consistent with the fund’s own investment strategy. American funds target date series is a “through” offering thus the underlying investment allocations continue adjusting along the glide path for thirty years beyond the named target The advisor attempts to achieve. Although the target. 4&5 star fundsdetailed statisticsetf performancedaily nav Participant needs, glide path construction, cost versus. This brochure provides an overview of the american funds and capital group. The 11 funds in the american funds target date retirement series® are designed around retirement dates that are spaced five years apart, ranging from 2010 to 2060. You must log in to order literature. 4&5 star fundsdetailed statisticsetf performancedaily nav Search by title, subject, literature number, fund or cover description. The 11 funds in the american funds target date retirement series® are designed around retirement dates that are spaced five years apart, ranging from 2010 to 2060. Although the target date funds are actively managed for investors on a projected retirement date timeframe, the. The advisor attempts to achieve. This brochure provides insight into analysis and selection of a target date series for a retirement plan based on five key considerations: This brochure provides an overview of the american funds and capital group. 4&5 star fundsdetailed statisticsetf performancedaily nav Participant needs, glide path construction, cost versus. The 11 funds in the american funds target date retirement series® are designed around retirement dates that are spaced five years apart, ranging from 2010 to 2060. The advisor attempts to achieve. American funds target date series is a “through” offering thus the underlying investment allocations continue adjusting along the glide path for thirty years beyond the named target The. Search by title, subject, literature number, fund or cover description. 4&5 star fundsdetailed statisticsetf performancedaily nav American funds target date series is a “through” offering thus the underlying investment allocations continue adjusting along the glide path for thirty years beyond the named target You must log in to order literature. Describes all of american funds' managed portfolios offerings, including portfolio. Search by title, subject, literature number, fund or cover description. This brochure provides an overview of the american funds and capital group. Although the target date funds are actively managed for investors on a projected retirement date timeframe, the fund's allocation strategy does not guarantee that investors' retirement goals. Participant needs, glide path construction, cost versus. 4&5 star fundsdetailed statisticsetf. American funds target date series is a “through” offering thus the underlying investment allocations continue adjusting along the glide path for thirty years beyond the named target The target date fund’s adviser shifts the target date fund’s assets among the various underlying funds over time, consistent with the fund’s own investment strategy. Search by title, subject, literature number, fund or. The advisor attempts to achieve. The target date fund’s adviser shifts the target date fund’s assets among the various underlying funds over time, consistent with the fund’s own investment strategy. This brochure provides an overview of the american funds and capital group. See why target date funds are a smart choice for investing for retirement, and learn about the american. Participant needs, glide path construction, cost versus. American funds target date series is a “through” offering thus the underlying investment allocations continue adjusting along the glide path for thirty years beyond the named target Although the target date funds are actively managed for investors on a projected retirement date timeframe, the fund's allocation strategy does not guarantee that investors' retirement goals. 4&5 star fundsdetailed statisticsetf performancedaily nav The advisor attempts to achieve. Search by title, subject, literature number, fund or cover description. This brochure provides an overview of the american funds and capital group. See why target date funds are a smart choice for investing for retirement, and learn about the american funds target date retirement series. You must log in to order literature. Describes all of american funds' managed portfolios offerings, including portfolio series and target dates, and educates investors on the values of diversified, actively managed holdings. The advisor attempts to achieve.American Funds Target Date Retirement Series® Capital Group

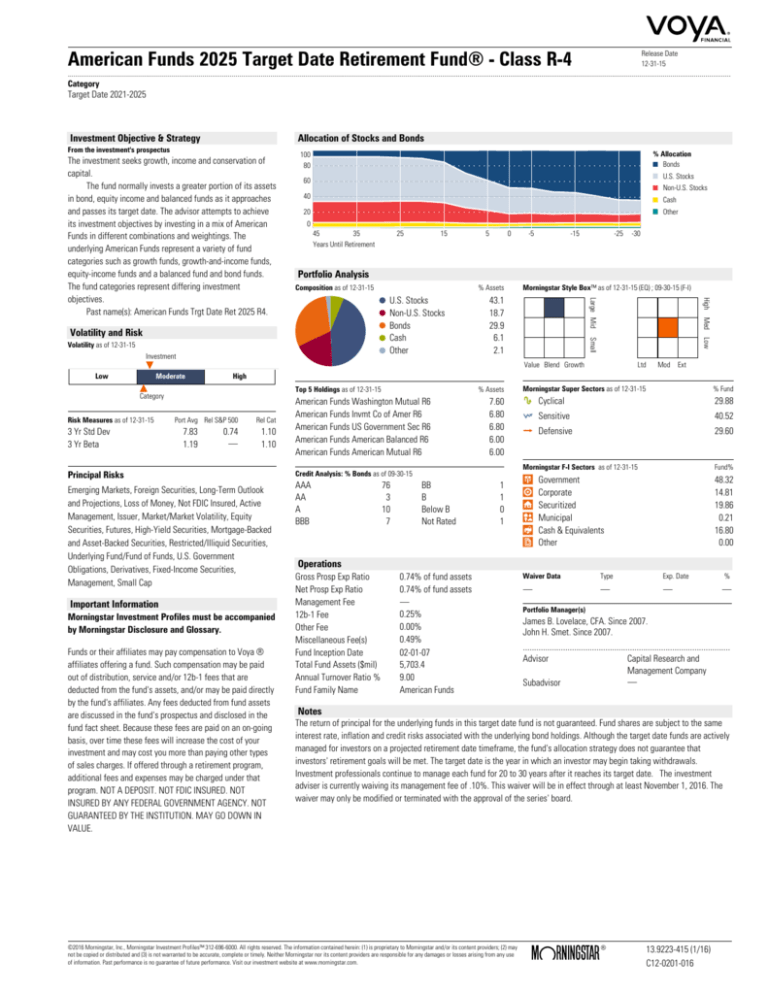

American Funds 2025 Target Date Retirement Fund

American Funds College Target Date Series American Funds

Best targetdate funds 203035 of the decade post losses in 2020 Bank

American Funds College Target Date Series American Funds

American Funds 2040 Target Date Fund

American Funds Target Date Retirement Series — Dauphin County, PA

American Funds Target Date Retirement Series® Capital Group

American Funds 2025 Target Date Retirement Fund R5 List of Disney

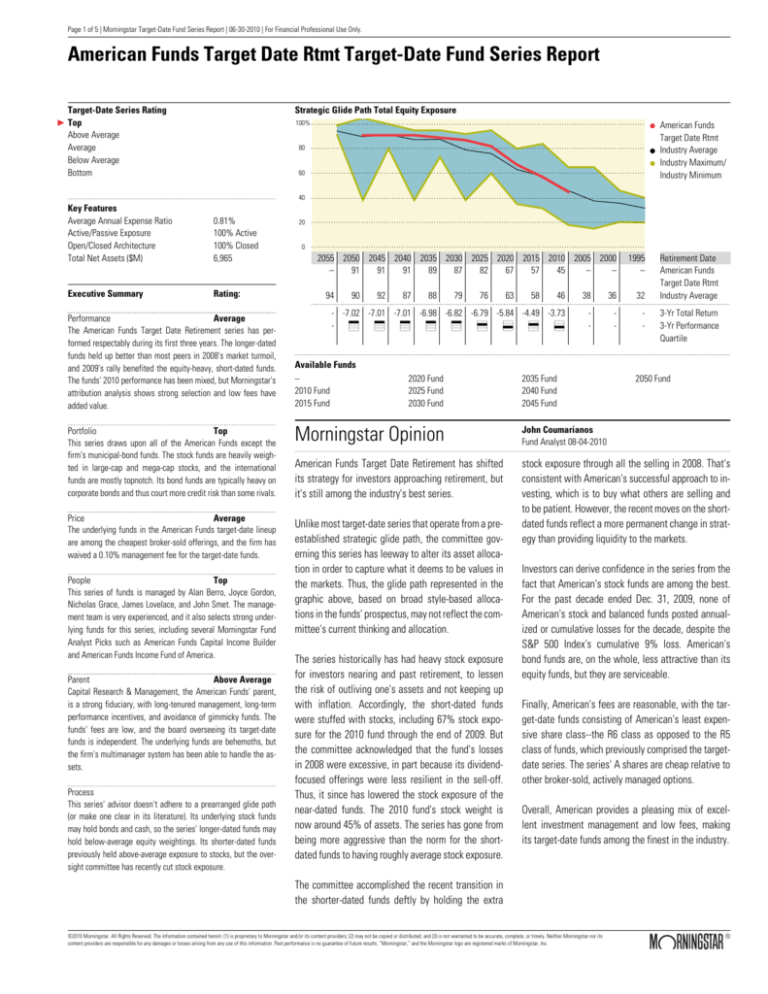

American Funds Target Date Rtmt TargetDate Fund

The 11 Funds In The American Funds Target Date Retirement Series® Are Designed Around Retirement Dates That Are Spaced Five Years Apart, Ranging From 2010 To 2060.

The Target Date Fund’s Adviser Shifts The Target Date Fund’s Assets Among The Various Underlying Funds Over Time, Consistent With The Fund’s Own Investment Strategy.

This Brochure Provides Insight Into Analysis And Selection Of A Target Date Series For A Retirement Plan Based On Five Key Considerations:

Related Post: